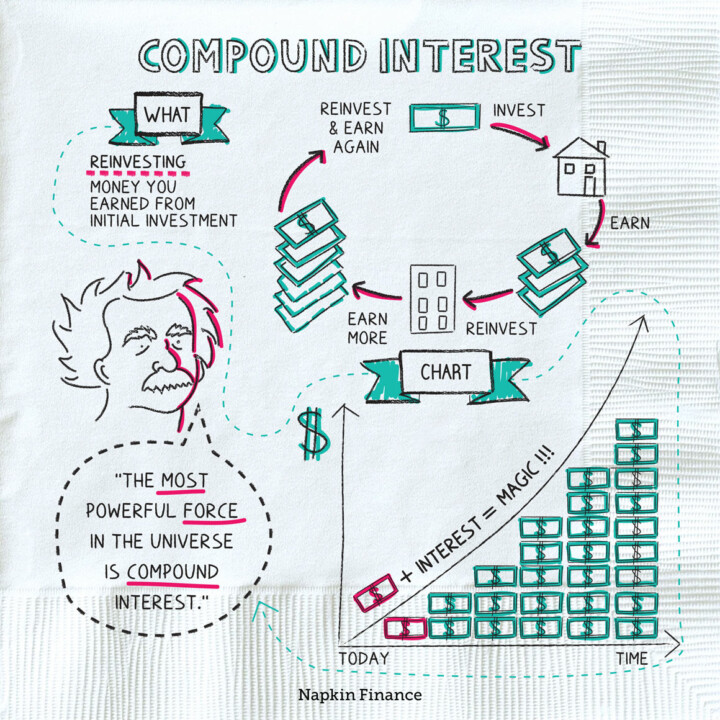

Compounding involves earning interest on the initial principal amount as well as the accumulated interest over time. This results in earning interest on your interest, which leads to a faster growth of your investment or debt.

Principal: The initial amount you invest or borrow.

Interest: The earnings generated on the principal.

When you invest or borrow, the initial amount is called the principal, and the earnings generated on the principal are known as interest. With compounding, the interest earned in each period is added to the principal, creating a larger base for calculating interest in the next period. This continuous cycle allows your investment or debt to grow exponentially, especially over long periods.

To better understand this concept, think of planting a seed (the principal). As it grows, it produces leaves (interest). These leaves, if left on the plant, can also contribute to further growth, similar to how your interest earns additional interest.

Compounding is often described as “interest on interest” and is a valuable tool for increasing wealth and managing debt. The sooner you begin compounding and the longer the compounding period, the greater the potential impact.

- Credits: What Is Compound Interest? (thebalancemoney.com)

- What Is Power of Compounding And How Does It Work? (goelasf.in)

- (2578) 26 – Compound Interest Formula & Exponential Growth of Money – Part 1 – Calculate Compound Interest – YouTube

- (2578) COMPOUND INTEREST explained for beginners 2023 (including rule of 72) 🚀 – YouTube

- Compound Interest (Definition, Formulas and Solved Examples) (byjus.com)

Updated On – 01 Mar 2024

Home Loan Interest Rate of all Banks 2024

| Banks | Starting Interest Rate (p.a.) | Processing Fees |

| Kotak Mahindra Bank | 8.70% p.a. onwards | Salaried: 0.5% Plus taxes; Self-Employed/Commercial: 1.0% Plus taxes. |

| Union Bank of India | 8.35% p.a. onwards | 100% processing fee waived for Union Home loans, valid from 16 November 2023 to 31 December 2023, CIC Score 700+ |

| Bank of Baroda | 8.40% p.a. onwards | No processing fee; discounted upfront fee. |

| Central Bank of India | 8.50% p.a. onwards | 0.50% up to Rs.20,000 Plus GST (waived till 31 March 2024) |

| Bank of India | 8.30% p.a. onwards | Full waiver on processing fees for new home loans until 31 December 2023. |

| State Bank of India | 8.60% p.a. onwards | Clean Overdraft: No charges. SBI Pension Loan: 1% or Rs.1000-10000 Plus GST. Jai Jawan Pension Loan: No charges. Xpress Credit: 1.50% or Rs.1000-15000 Plus GST. |

| HDFC Home Loans | 8.50% p.a. onwards | Up to 0.50% or Rs.3000 Plus taxes, whichever is higher. Minimum retention: 50% or Rs.3000 Plus taxes, whichever is higher. |

| LIC Housing Finance | 8.85% p.a. onwards | For amounts up to Rs.1 crore, it is 0.25% of the loan amount, with a maximum of Rs.15,000 Plus GST.For amounts above Rs.1 crore and up to Rs.2 cr0re, the fee is Rs.20,000 Plus GST.For amounts above Rs.2 crore and up to Rs.5 crore, the fee is Rs.25,000 Plus GST.For amounts above Rs.5 crore and up to Rs.15 crore, the fee is Rs.50,000 Plus GST. |

| Axis Bank | 8.70% p.a. onwards | Up to 1% or min. Rs.10,000 Plus GST |

| Canara Bank | 8.55% p.a. onwards | Contact the bank |

| Punjab and Sind Bank | 8.55% p.a. onwards | 0.15% of the loan amount will be charged, with a minimum of Rs.1000 and a maximum of Rs.3750. For loans above Rs.25 lakh and up to Rs.50 lakh, the fee is 0.25% of the loan amount, capped at a maximum of Rs.12500. Similarly, loans above Rs.50 lakh but less than Rs.75 lakh incur a fee of 0.25% of the loan amount, with a maximum limit of Rs.15000. Loans of Rs.75 lakh and above carry a charge of 0.25% of the loan amount. |

| IDFC First Bank | 8.75% p.a. onwards | Up to 3% of the overall loan amount. |

| Bank of Maharashtra | 8.35% p.a. onwards | No processing fees. |

| Indian Overseas Bank | 8.85% p.a. onwards | Processing charges are completely waived, entailing a 100% exemption. |

| Punjab National Bank | 8.40% p.a. onwards | Nill |

| UCO Bank | 8.45% p.a. onwards | Contact the Bank. |

| IDBI Bank | 8.45% p.a. onwards | 0.50% (Rs. 2,500 – Rs.5,000) |

| HSBC Bank | 8.45% p.a. onwards | 1% of loan amount or Rs.10,000, whichever is higher. |

| Karur Vysya Bank | 8.95% p.a. onwards | Loans up to Rs.25 Lakhs incur a charge of Rs.2,500 Plus GST.Loans ranging from Rs.25 Lakhs to Rs.50 Lakhs carry a processing fee of Rs.5,000 Plus GST.For loans exceeding Rs.50 Lakhs, the processing fee is Rs.7,500 Plus GST. |

| Saraswat Bank Home Loan | 8.60% p.a. onwards | Up to Rs.35 lakh: NlRs.35 lakh – Rs.50 lakh: 0.30% of loan amountRs.50 lakh – Rs.70 lakh: 0.40% of loan amountRs.70 lakh – Rs.1.40 lakh: 0.50% of loan amount |

| Jammu and Kashmir Bank | 8.75% p.a. onwards | 0.50% Plus GST (min. Rs.2,000 and max. Rs.50,000) |

| South Indian Bank | 8.50% p.a. onwards | 0.50% of the loan amount or a minimum of Rs. 5,000 + GST |

| PNB Housing Finance Limited | 8.50% p.a. onwards | Up to 1.00% |

| Federal Bank | 8.80% p.a. onwards | Contact the bank |

| Standard Chartered Bank | 8.65% p.a. onwards | Contact the bank |

| Aavas Financiers | Contact the bank | 1.00% |

| Karnataka Bank | 8.58% p.a. onwards | Contact the bank |

| Sundaram Home Finance | Contact the bank for information on the floating/variable interest rate linked to market lending rates. | Up to 0.75% of the loan amount plus applicable GST. |

| Dhanlaxmi Bank | Contact the bank | 1.00% of the loan amount, Plus service tax (with a minimum of Rs.10,000 Plus service tax). |

| Tata Capital | 8.70% p.a. onwards | Rs.999 Plus GST |

| Tamilnad Mercantile Bank | 9.45% p.a. onwards | 0.50% of loan amount Plus GST |

| Bandhan Bank | 9.16% p.a. onwards | 0.25% to 1.00% plus GST |

| Yes Bank | 9.40% p.a. to 10.25% p.a. | 1.5% of the loan amount plus GST or Rs.10,000, whichever is higher |

| Hudco Home Loan | 9.25% p.a. onwards | Nil |

| Indiabulls | 9.30% p.a. onwards | 0.50% onwards |

| Aditya Birla | Contact the bank | Up to 1% |

| GIC Housing Finance | 8.80% p.a. onwards | Rs.2,500 Plus Applicable GST |

| Reliance Home Finance | 9.75% p.a. onwards | Up to 1.5% |

| Shriram Housing | 9.50% p.a. onwards | Up to 2.5% of the loan amount Plus applicable taxes. |

| India Shelter Finance | 10.50% p.a. to 20% p.a. | 2.50% Plus Taxes as processing fee |