Behind the facade of aspirational living, the middle class in India is grappling with stagnant wages, rising expenses, and an impending sense of financial instability.

The Indian middle class, often hailed as the backbone of the nation’s consumption-driven growth story, is quietly grappling with a profound crisis. A recent viral LinkedIn post by Ashish Singhal, CEO of PeepalCo, has ignited a much-needed conversation, exposing the widening chasm between stagnant salaries and rapidly escalating living costs. This isn’t a sudden collapse, but as Singhal aptly puts it, a “well-dressed decline.”

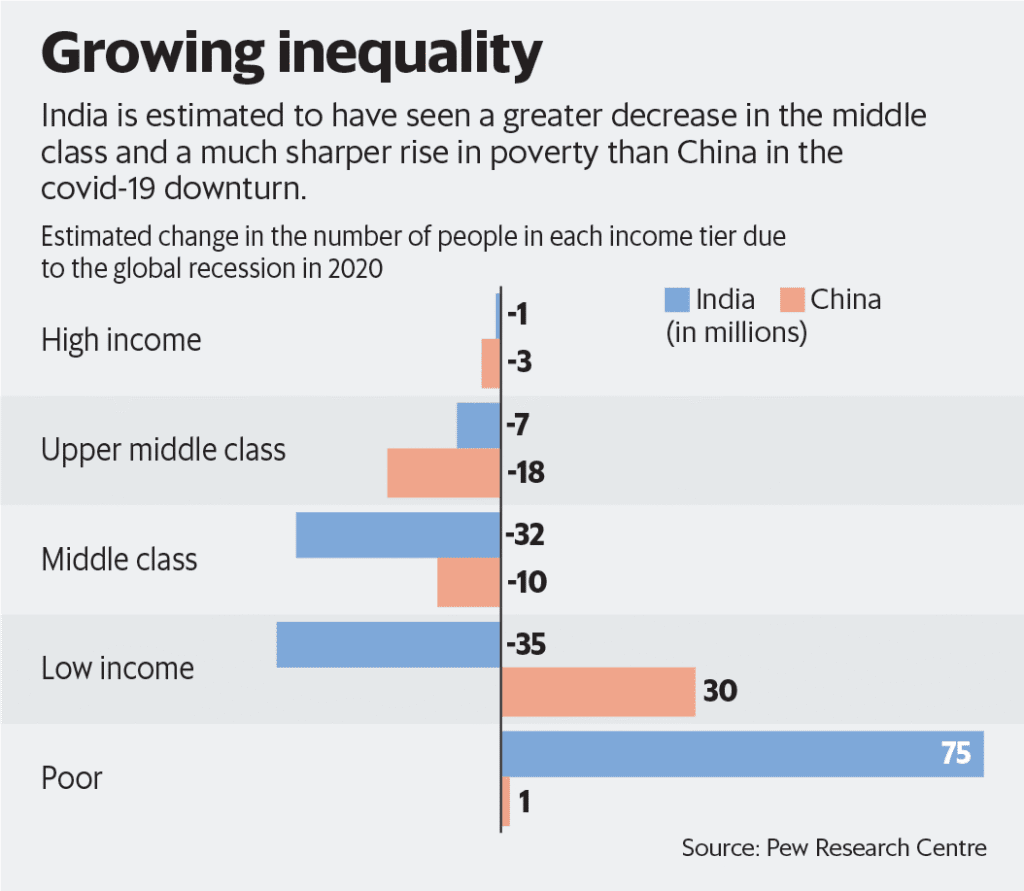

The Stark Reality: Numbers Don’t Lie

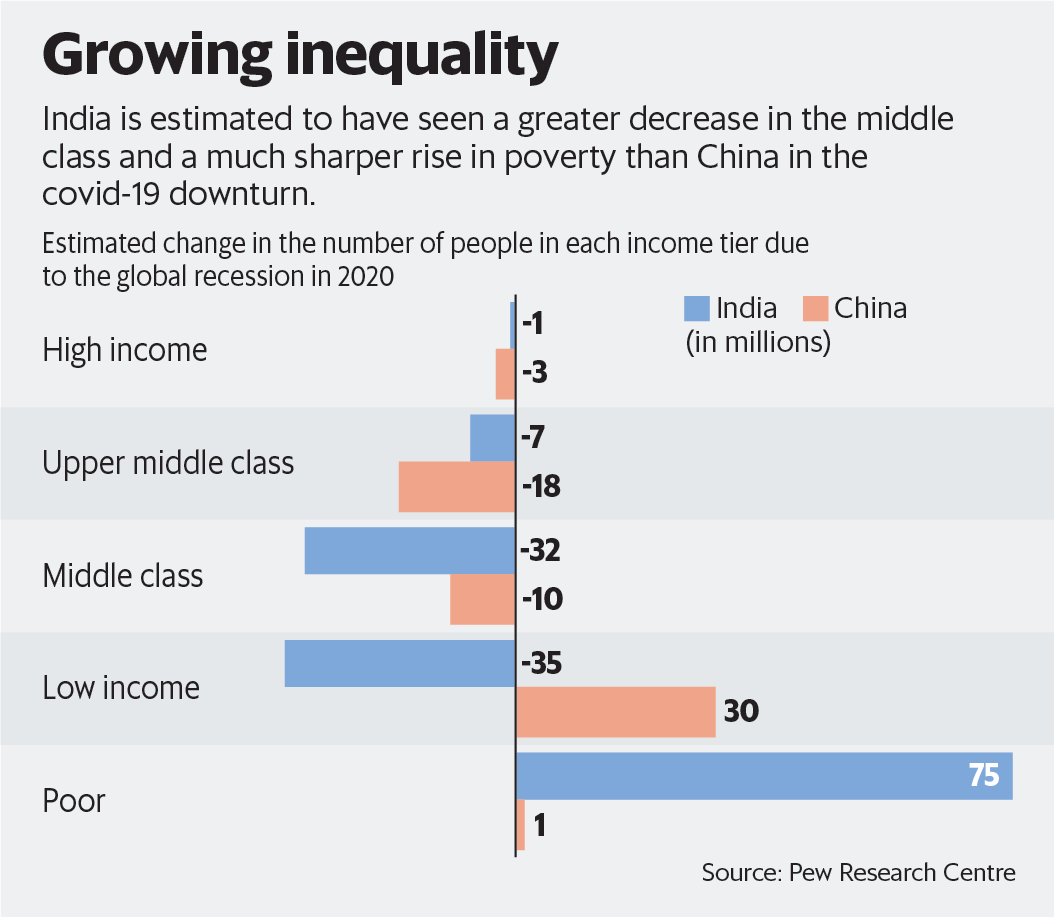

In the last ten years, a considerable portion of the Indian middle class, defined as those with annual incomes ranging from ₹5 lakh to ₹1 crore, has experienced a meagre Compound Annual Growth Rate (CAGR) of just 0.4% in their earnings. In sharp contrast, the cost of essential goods has escalated significantly. For example, food prices have soared by almost 80% during this timeframe, effectively reducing purchasing power by half. This troubling situation indicates that although families may still afford vacations, upgrade their mobile devices, and meet their equated monthly instalments (EMIs), they frequently do so at the expense of vital savings, insurance, and even postponing medical appointments.

The Illusion of Prosperity

The aspirational lifestyle often associated with the Indian middle class is increasingly funded by credit rather than genuine income growth. Credit card usage is up, and EMIs are ballooning, creating a precarious financial tightrope. This silent struggle is often masked by outward appearances, making it a “scam no one talks about”, as Singhal rightly points out.

Why the Squeeze?

Several factors contribute to this growing crisis:

Stagnant Wage Growth: Despite overall economic growth, middle-class salaries have not kept pace with inflation, severely impacting their real earning power.

Soaring Cost of Living: Housing, education, healthcare, and daily essentials continue to rise at an alarming rate, consuming a larger share of household budgets.

Insufficient Social Security: Unlike the poor, who benefit from various welfare schemes, or the rich, who scale through investments, the middle class often lacks adequate government support or safety nets to absorb economic shocks.

Automation and AI: The increasing prevalence of automation and artificial intelligence is beginning to disrupt white-collar jobs, adding another layer of insecurity to an already strained demographic.

Debt Burden: To maintain desired lifestyles, many middle-class households resort to consumer loans and credit card debt, further increasing their financial vulnerability.

The Broader Implications

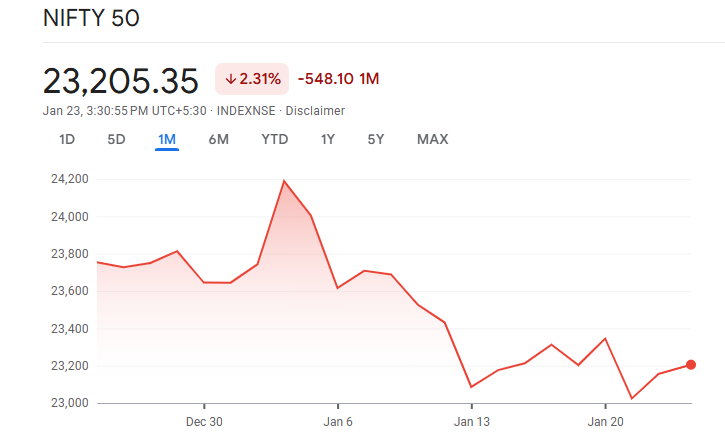

This silent squeeze on the middle class is not merely a personal financial struggle; it has significant macroeconomic implications. The middle class is a critical driver of consumption and tax revenue. A financially distressed middle class can lead to reduced spending power, slower retail growth, and ultimately, temper the nation’s GDP performance.

While projections suggest India’s middle class will grow significantly in numbers (from 31% in 2021 to an estimated 60% by 2047), the erosion of their financial well-being is a sobering truth that needs urgent attention.

Addressing India’s middle-class salary crisis requires a multi-faceted approach. This includes:

Policy Focus: Governments need to recognise the unique challenges faced by this segment and implement policies that offer tangible relief, such as tax benefits, affordable housing initiatives, and strengthened labour market policies.

Wage Reforms: Encouraging wage growth that outpaces inflation is crucial to ensure real income gains for the middle class.

Financial Literacy and Planning: Empowering individuals with better financial literacy can help them navigate the economic landscape and make informed decisions about savings and investments.

Investment in Skill Development: As technology evolves, continuous upskilling and reskilling programs are essential to ensure the middle class remains competitive in the job market.

The Indian middle class is resilient, but their silent suffering cannot be ignored. It’s time for a collective effort from policymakers, industries, and individuals to acknowledge this crisis and work towards a more financially secure future for the very segment that powers India’s economic engine.